Cleanzine: your weekly cleaning and hygiene industry newsletter 26th June 2025 Issue no. 1168

Cleanzine: your weekly cleaning and hygiene industry newsletter 26th June 2025 Issue no. 1168

Your industry news - first

The original and best - for over 20 years!

We strongly recommend viewing Cleanzine full size in your web browser. Click our masthead above to visit our website version.

Waste management companies likely to see high M&A activity in 2022 and beyond

A new report on the global economy lists waste management as one of the top three industries likely to experience high merger & acquisition activity in 2022 and beyond.

A new report on the global economy lists waste management as one of the top three industries likely to experience high merger & acquisition activity in 2022 and beyond.

Buying another company has increasingly replaced research & development to become the preferred growth and innovation strategy across many sectors of the global economy. As markets continue to grapple with the aftermath of the pandemic and a treacherous geopolitical landscape, the lack of stability needed to grow organically has seen the number of deals reaching record levels. In fact, US$5 trillion dollars-worth of M&A deals have been completed in the last year alone.

While central banks around the world are struggling to contain soaring inflation by raising interest rates from their historic lows, access to cheap money remains historically easy.

The reasons for so many deals over the latest year, despite the raging of the pandemic and political instability in previously stable markets, are many. Acquiring human expertise and skills to ensure a place in key markets, buying in intellectual property to achieve the same, buying up or down a value chain, bringing a key supplier in house, the list is endless.

Deals are happening at all levels of the economy, from the $40bn deal agreed between AT&T and the parent company of the Discovery Channel down to localised agreements, potential affecting companies close to you.

But, as we continue to ride a tidal wave of deals and corporate mergers, where are the industry hotspots where consolidation is most likely? Plimsoll examines thousands of sectors around the world, analysing key companies and identifying M&A opportunities and trends in key financial performance indicators.

Its graphical analysis and valuation model specialises in isolating strong and weak companies. The markets with the widest disparity between those two performance levels are the industries the company feels are likely to see the most deals. Financially strong businesses consume their under-capitalised peers to find growth and even enter new markets.

Its graphical analysis and valuation model specialises in isolating strong and weak companies. The markets with the widest disparity between those two performance levels are the industries the company feels are likely to see the most deals. Financially strong businesses consume their under-capitalised peers to find growth and even enter new markets.

Based on its thousands of industry-specific studies, Plimsoll has found three markets where there is likely to be an outsized number of deals over the next three years: Seafood, Cement & Concrete Manufacturers, and Waste Management.

The global waste management market is projected to be worth more than half a trillion dollars within the next three years. After COP26 and the accepted need for cleaner business and better management of human-induced waste, demand will continue to grow and diversify regardless of external challenges such as war and pandemics.

As demand grows and evolves, so consolidation looks set to increase. The growing issue of e-waste created by modern electronic shortens has led to an increased need to acquire new expertise. Expanding into emerging markets and even aligned industries could further increase companies' willingness to acquire established companies.

Plimsoll's latest analysis of the waste management market shows that just under a third of leading companies are financially weak – indeed the report rates 279 companies as being ‘in danger’. With nine out of 10 previously failed global waste management companies given the same danger rating two years prior to their demise, the analysis is likely to give an early warning of who is next.

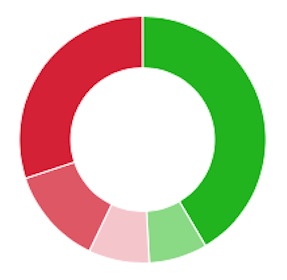

Each of the 928 global waste management companies included in the analysis has been rated Strong, Good, Mediocre, Caution or Danger. These ratings are based on Plimsoll’s graphical model which highlights the current strength of each company and measures change in performance over the previous four years.

The following is a breakdown this month’s performance ratings:

• Strong (385 companies)

• Good (71 companies)

• Mediocre (74 companies)

• Caution (119 companies)

• Danger (279 companies)

110 companies are attractive for takeover, with:

• 48 high value targets - These outstanding companies are financially strong and growing quickly. They would be an excellent acquisition but you would need to pay a high price.

• 23 high growth / financially weak targets - These exciting companies are growing rapidly but their financial health is declining. Many require only small changes to be returned to profit to profitability and financial stability.

• 74 highest Potential targets - These struggling companies are financially weak with many making a loss. They offer an opportunity to buy a weakened company for a low price and turn it around.

• 74 high profit / low growth targets - These companies are very profitable but are growing very slowly. New owners could try to get these companies back to growth or continue to enjoy their outstanding profit margins.

The analysis also provides a valuation for each of the previous four years and also a ‘future year’ showing what it could be worth in the future.

For further information and to buy a copy of the report, visit:

10th March 2022